15+ paycheck calculator ri

Well do the math for youall you need to do is. We designed a handy payroll calculator to ease your payroll tax burden.

Rhode Island Judiciary Judicial Law Clerk Salaries Glassdoor

For example if an employee earns 1500 per week the individuals annual.

. Calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax liability. Your average tax rate is 1198 and your. Rhode Island Salary Paycheck Calculator Change state Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

71 Arm Mortgage Rates. Simply enter their federal and state W-4 information. Youll then get your estimated take home pay a detailed.

Payroll Tax Salary Paycheck Calculator Rhode Island Paycheck Calculator Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Rhode Island Income Tax Calculator 2021. Rhode Island has a progressive state income tax system with three tax brackets.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Enter your employment income into the paycheck calculator above to find out how taxes in Rhode Island USA affect your finances.

Rhode Island Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. The tax rates vary by income level but are the same for all. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Rhode Island. 51 Arm Mortgage Rates. Overview of Rhode Island Taxes.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Rhode Island. All you need to do is enter wages earned and W-4 allowances for each of your employees.

Supports hourly salary income and multiple pay frequencies.

80 S Birthday Invitation Digital File You Print Etsy

Rhode Island Salary Paycheck Calculator Gusto

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Hr And Payroll Software For Manufacturing Global Shop Solutions

Paycheck Calculator Apo Bookkeeping

East Bay Village Apartments 969 W Main Rd Middletown Ri Rentcafe

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Hr And Payroll Software For Manufacturing Global Shop Solutions

Google Rolls Out Pay Calculator Explaining Work From Home Salary Cuts R Technology

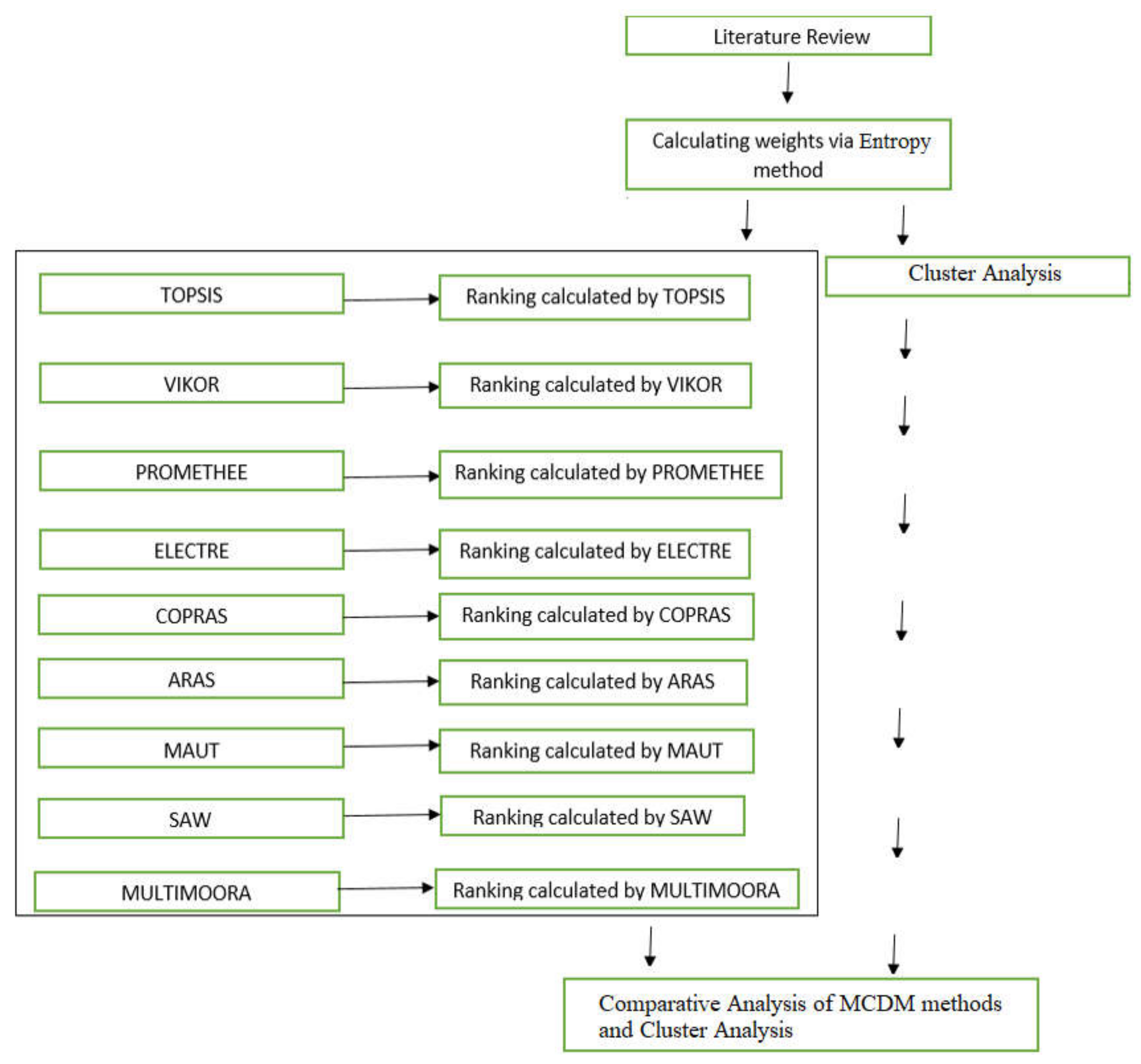

Sustainability Free Full Text Science Technology And Innovation Policy Indicators And Comparisons Of Countries Through A Hybrid Model Of Data Mining And Mcdm Methods Html

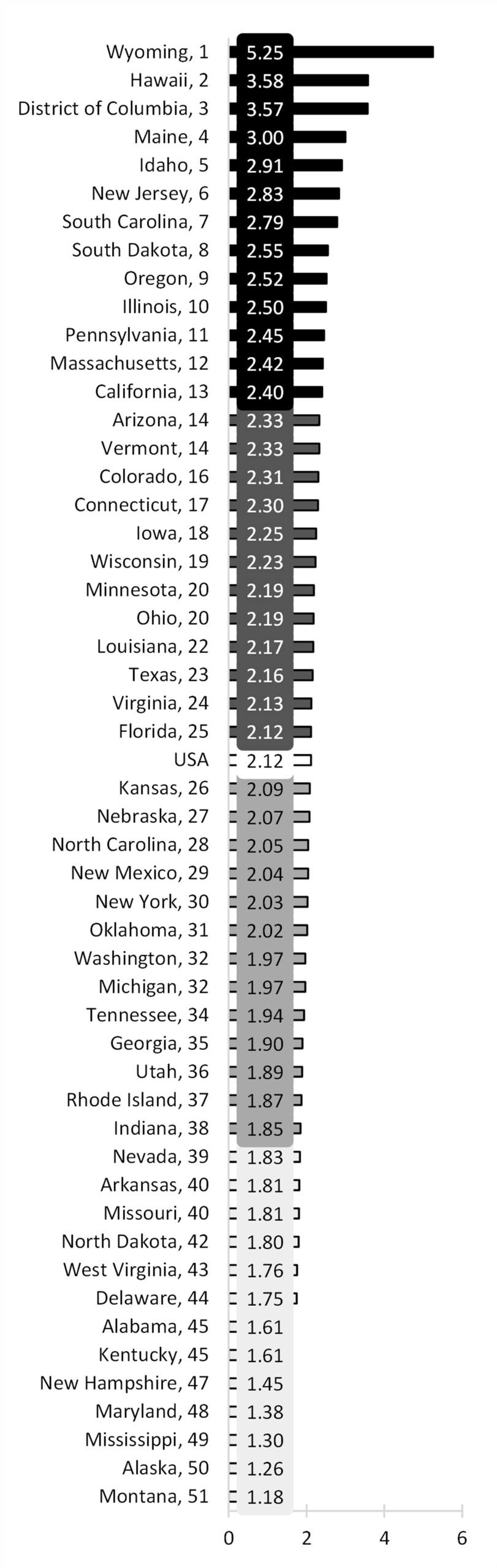

Marriage To Divorce Ratio In The U S Geographic Variation 2020

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Free Paycheck Calculator Hourly Salary Smartasset

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

Rhode Island Salary Calculator 2022 Icalculator

Edh Blog E D Hovee Company Llc

Paycheck Calculator Salaried Employees Primepay