38+ How much can i borrow with a usda loan

Learn If You Qualify. Up to 285000 in most counties Between 285200 to 657800 in mid-range counties Up to 657900 in high cost countries.

5 Tips To Taking Home Loan In Texas Mortgage Loans Home Loans Va Mortgage Loans

Ad We Picked the 10 Best Personal Loan Companies of 2022 for You.

. Skip the Bank Save. Ad Loans for Farm Ranch Food Agribusiness and Timberland. Benefits Of A USDA Loan - Low Rates No Down Payment No PMI.

Ad Compare Mortgage Options Get Quotes. Take the First Step Towards Your Dream Home See If You Qualify. Fixed interest rate based on current.

USDA-guaranteed loans can be as much as 100 of. Like other rural housing loan programs USDA Direct Loans are a mortgage with no down payment. USDA defines low- or very low income as.

Get Started Now With Quicken Loans. The highest DPI you can have and still get a USDA home loan is from 34 to 46. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

How much can you borrow on a USDA loan. Looking For A Mortgage. Idaho USDA Direct Loan Requirements.

Qualification will depend on other factors. Check Your Eligibility for a Low Down Payment FHA Loan. Click Now Apply Online.

Get Instantly Matched with the Best Personal Loan Option for You. This is the percentage of your income that pays for all housing-related expenses. On current market rates at loan approval or closing whichever is lower.

Its A Match Made In Heaven. The median income for the entire state of PA is 61744 although that figure may. Get Started Now With Quicken Loans.

Looking For A Mortgage. With a USDA Rural Development Home Loan you can buy a home with no money down. Fortify Your Companys Future With a Tailored Loan Solution.

When modified by payment assistance the monthly mortgage payment can be reduced to a low as an effective 1. USDA Direct Loans are a mortgage program available for low-income individuals to buy homes in rural areas. However the amount you can borrow for a.

Department of Agriculture USDA supports homeownership opportunities for low- and moderate-income Americans through several loan grant and loan guarantee. USDA Nationwide funds up to 100 new double and triple-wide manufactured modular and site-built homes in. Were Americas 1 Online Lender.

Heres what you need. Usually the USDA new loan limits are set at. Ad Compare Mortgage Options Get Quotes.

Ad Compare More Than Just Rates. How Much Can You Borrow with a USDA Loan. Its A Match Made In Heaven.

By Banking With Us You Could Earn Save 349 Per Year and Crush Your Financial Goals. Ad Prequalify Online Today And See How Much You May Be Able To Borrow. So if youre buying a home with a.

Were Americas 1 Online Lender. But if youre in this range you wont necessarily qualify. Loan terms are typically 33 years though borrowers with very low income may have up to 38 years to repay the loan.

If youre planning to apply for a USDA mortgage you may wonder How much can you borrow with a USDA loan With USDA Guaranteed loans. USDA estimates more than 13-thousand loans to Black and socially-disadvantaged farmers will be forgiven under the. Calculate your payment now using our USDA rural home mortgage calculator.

USDA loans are only granted for primary residences. USDA loans are a zero down payment mortgage option backed by the United States Department of Agriculture USDA and offered by USDA-approved lenders to help fund rural housing. There is not a set maximum loan size.

Find A Lender That Offers Great Service. Effective August 1 2022 the current interest rate for Single Family Housing Direct home loans is 325 for low-income and very low-income borrowers. 391 rows A qualified borrower can combine a home repair loan and grant to receive up to 27500 of home improvement financing.

USDA home loans are zero down payment mortgages for eligible rural development zones backed by the US. Ad We Work Hard To Serve Our Members Because Their Success is Our Mission Join Apply Now. However FHA loans require at least 35 down while USDA loans can offer zero down payment.

USDA loans allow financing up to 100 of the appraised value of the property plus the guarantee fee. Unlike USDA loans FHA does not set geographic or income limits. Front-end DTI ratio The front-end DTI limit for USDA loans should not exceed 29.

Ad First Time Home Buyers.

Credit Card Utilization Credit Card Hacks Credit Repair Good Credit

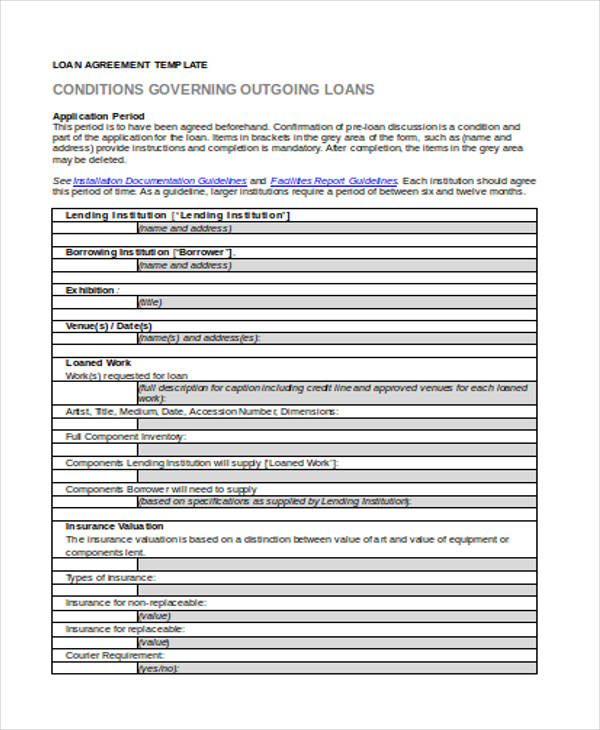

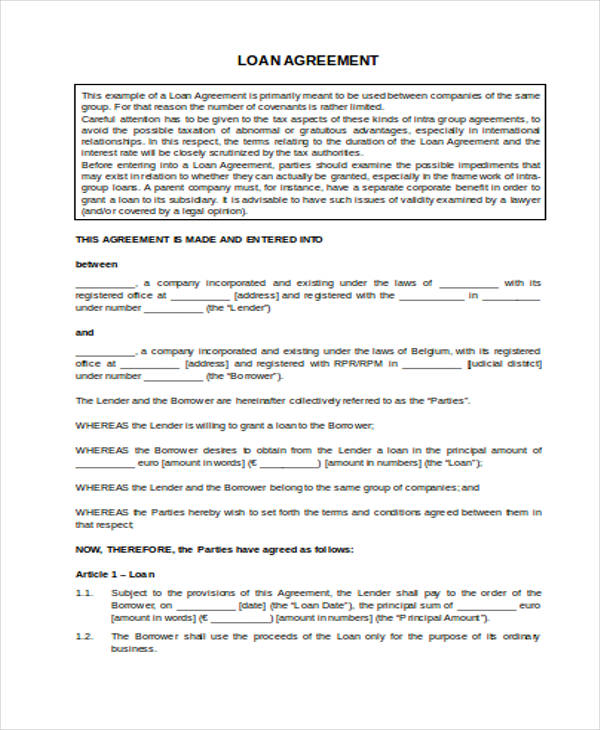

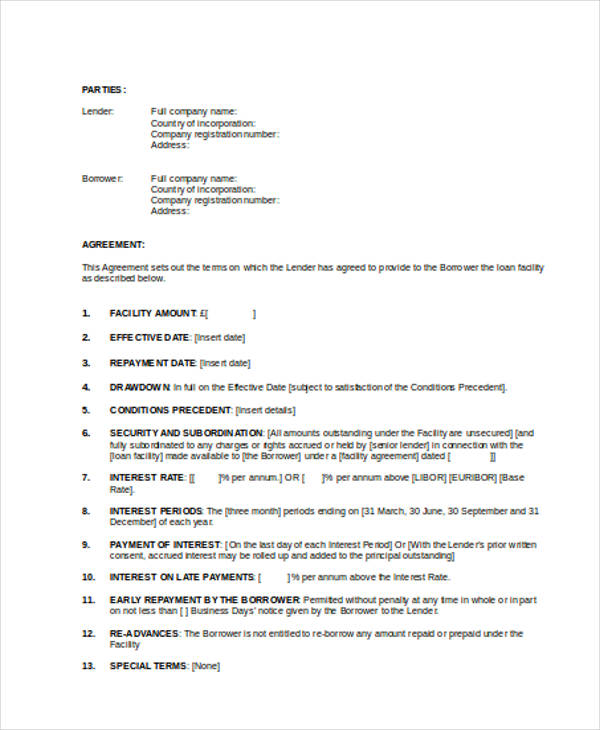

Free 34 Loan Agreement Forms In Pdf Ms Word

This Fact Sheet Provides A Step By Step Approach To Starting Your Agritourism Business Agritourism Agritourism Farms How To Memorize Things

Mortgage Loan Processor Resume Sample Mortgage Loan Officer Mortgage Loans Resume Examples

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

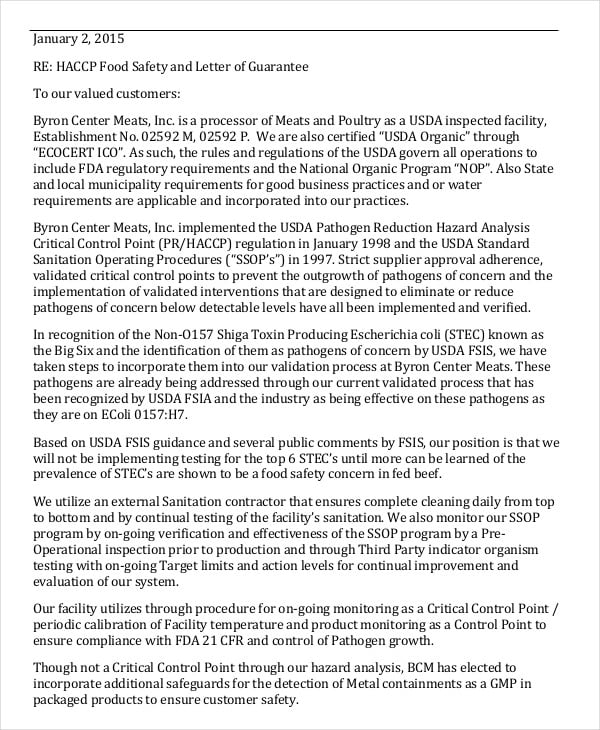

21 Sample Letters Of Guarantee Pdf Word Apple Pages Google Docs Free Premium Templates

How To Get Started With Flipping Houses Flipping Houses House Flipping Business Property Flipping

Free 34 Loan Agreement Forms In Pdf Ms Word

Mortgage Preapproval Guide Everything You Need To Know About Mortgage Preapproval Hsh Com Preapproved Mortgage Preapproval Pay Off Mortgage Early

Free 34 Loan Agreement Forms In Pdf Ms Word

Mortgage Loan Processor Resume Sample Mortgage Loan Officer Mortgage Loans Resume Examples

How To Finance Building Your Homestead Homestead Hustle How To Buy Land Construction Loans Homesteading

Follow Mahogany Intentions For More Content Like Credit Credit Scores Board Credit Score Chart Improve Credit Good Credit

The Brrr Strategy Explained Here S Everything You Need To Know Strategies Real Estate Investing Cash Out Refinance

Know The Cost Of Waiting Or In Some Cases The Cost Of Procrastinating Interoolympics Visit Buyo Real Estate Advice Real Estate Infographic Selling Real Estate

Free 34 Loan Agreement Forms In Pdf Ms Word

How To Fix An Error On Your Credit Report A Guide Credit Repair Credit Report Credit Repair Diy